How to Read Your Paystub

There is a surprising number of numbers involved in getting paid. While you only see the very last one - the net pay that actually hits your bank account - they all mean something useful! Here’s an example of a full paystub, or “Earnings Statement”, below. Let’s break it down.

Towards the Top

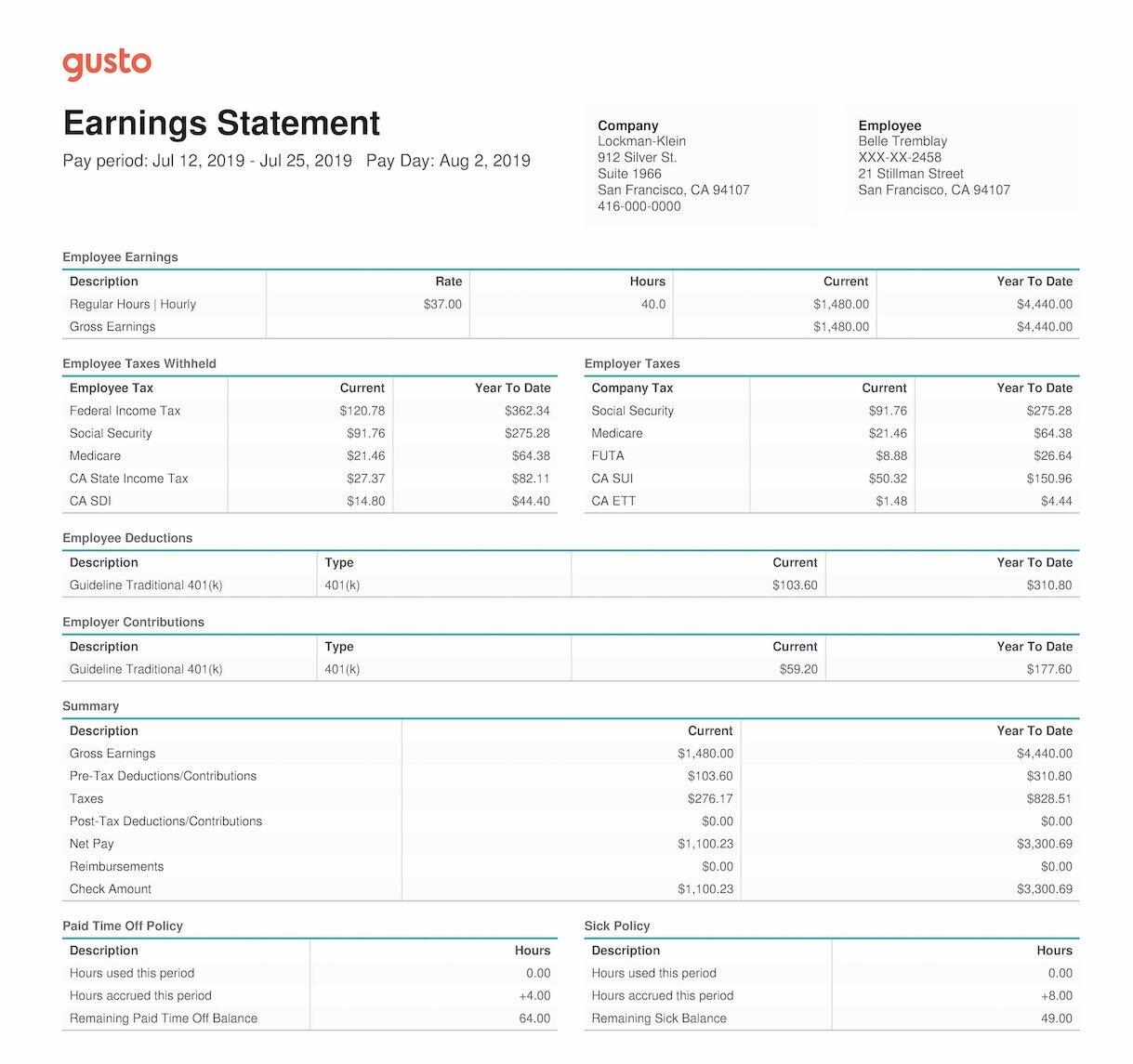

First, the top. This is generally where all the information about you and your employer are located. Great. But you’ll also notice that there are pay dates as well. You can see the start and end date of the pay period, as well as the date that you're actually getting the pay for that time period. Notice that it’s not always the same day! You can see in this example - this employee actually gets paid a week after they’ve finished earning the money for that pay period.

Something missing from this example is tax status. Your tax status (that you filled out on your W-9 when you were first hired) determines how much money your employer withholds from your paycheck throughout the year for taxes. While this information would generally appear on your paystub, it sometimes doesn’t and is worth verifying to make sure that it is correct. For example, if you’re single it should generally state something like ‘Single, 1’.

You want to make sure this number is correct so that the proper amount is withheld from your paycheck - if too little is withheld you will owe money when you file taxes, but if too much is withheld then you will get a larger refund (and you don’t want a large refund because you want to have access to your hard earned money sooner than that!). You don’t want to have to wait potentially up to the following April to get some of the money you had earned way back the previous January! Even though it can mentally be exciting to get a big lump sum, it’s not typically financially smart.

On to the Numbers - Gross Earnings

Ok, moving on to the numbers. For this paycheck let’s start with the ‘Employee Earnings’. This section lists all the different types of pay that the employee has been paid so far that year. Notice how you can see the YTD column just after the “Current” pay period column. It looks like this person worked 40 hours during this pay period. Note that these earnings are “gross”, which means they are what you’ve earned before taxes or anything else is taken out or before taxes. This is NOT what you see in your bank account. (Sad, I know.)

Deductions and Taxes

Next come deductions! Yay. Deductions are items that are taken out before taxes are figured - this means that you aren’t paying taxes on the cost of these items, which effectively saves you money. Note that this paystub lists them confusingly in reverse order.

This employee is contributing to their traditional 401(k), which is taken out before taxes are calculated on the employee’s earnings. In this case, the $103.60 contribution from this pay period is subtracted directly from the $1,480 the employee earned this period before taxes are calculated - as in, the employee is not paying tax on his 401(k) contribution. This is also where any other deductions would be listed - any health insurance premium, commuter benefits, HSA or FSA contributions, or any other pre-tax employee benefit would be listed.

Then come the taxes themselves - federal income tax, Social Security, Medicare, state income tax (in this case California), and California’s state disability income tax as well. Taxes are calculated after deductions are taken out - they are calculated using the federal tax brackets and your respective state tax brackets. (More on this coming in a future post!)

Next up you’ll notice that this employer provides a 401(k) match to this employee. Exciting! We can actually calculate the percentage match by doing $59.60 (the employer’s contribution in this pay period) / $1,480 (the employee’s gross pay in this pay period). Doing that we get a match of almost exactly 4% of gross pay. Not bad.

Note: Make sure you are taking 100% advantage of your employer match! It’s as close to ‘free money’ as you will likely see in this lifetime.

Ta da! This brings us to ‘Net Pay’ - aka what DOES hit your bank account! This paystub has a nice summary of everything we just discussed here - gross pay, deductions, taxes, net pay. Many paystubs also list the checking or savings account where the paycheck was deposited. You can even have your paycheck split automatically between two accounts - quite a nice feature (here’s why).

There you have it!

At a new job? Need help deciphering your first paycheck? Reach out to Sarah to set up a time to talk!

Sign up for blog updates to stay on top of the latest Momentum blog posts!